Spencer Platt/Getty Images News

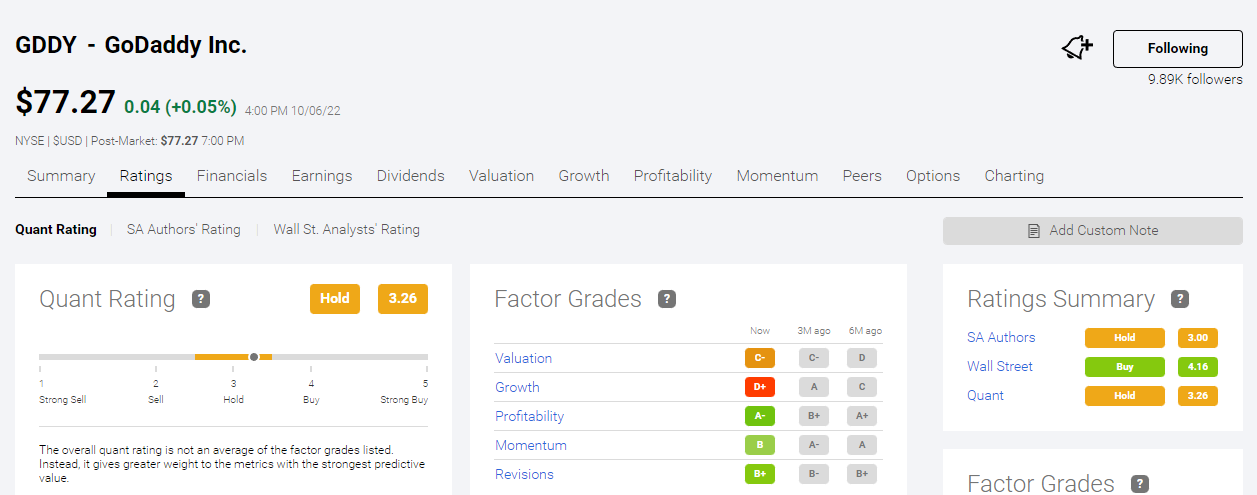

I disagree with the Hold rating that Seeking Alpha’s quantitative assessment algorithm gave GoDaddy, Inc. (NYSE:GDDY). The decades-long survival of GoDaddy in the web hosting business is prima facie evidence of its tenacity and brilliancy. The TTM revenue CAGR of GDDY is 12.70%. Seeking Alpha’s Hold rating for GDDY is largely because of its growth grade of D+.

Seeking Alpha Premium

Seeking Alpha authors have a consensus hold rating for GoDaddy Inc. My dissenting opinion is that GDDY deserves a buy recommendation. This article will show that GoDaddy has other redeeming qualities. Other authors and the AI of Seeking Alpha’s quantitative platform are unhappy with GoDaddy because of that 12.70% TTM revenue CAGR.

The 10-year average CAGR of GoDaddy is 16.03%….

Source link

Wall Street brokerages predict that GoDaddy Inc. (NYSE:GDDY) will post $970.53 million in sales for the current quarter, according to

Wall Street brokerages predict that GoDaddy Inc. (NYSE:GDDY) will post $970.53 million in sales for the current quarter, according to