Many investors define successful investing as beating the market average over the long term. But in any portfolio, there are likely to be some stocks that fall short of that benchmark. Unfortunately, that’s been the case for longer term Dominion Hosting Holding S.p.A. (BIT:DHH) shareholders, since the share price is down 30% in the last three years, falling well short of the market return of around -5.0%. Furthermore, it’s down 28% in about a quarter. That’s not much fun for holders. But this could be related to the weak market, which is down 24% in the same period.

View our latest analysis for Dominion Hosting Holding

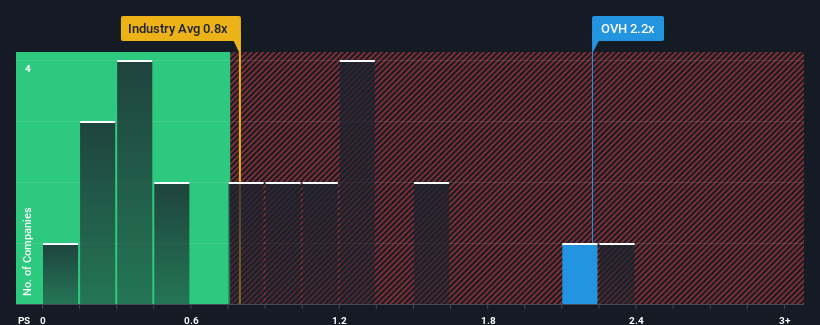

We don’t think that Dominion Hosting Holding’s modest trailing twelve month profit has the market’s full attention at the moment. We think revenue is probably a better…

Source link