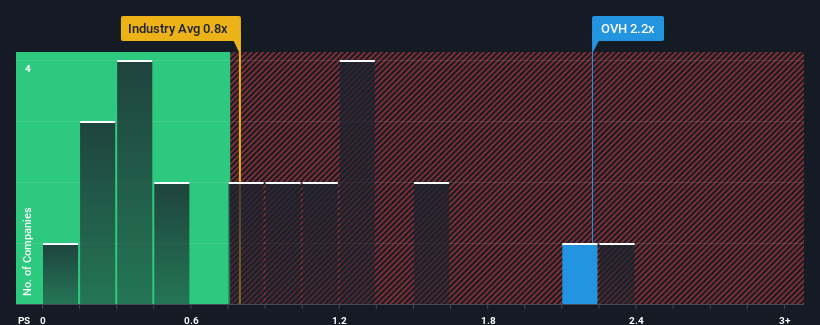

When close to half the companies in the IT industry in France have price-to-sales ratios (or “P/S”) below 0.8x, you may consider OVH Groupe S.A. (EPA:OVH) as a stock to potentially avoid with its 2.2x P/S ratio. Nonetheless, we’d need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for OVH Groupe

How Has OVH Groupe Performed Recently?

Recent times have been advantageous for OVH Groupe as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price….

Source link